Ethereum Price Prediction: How High Will ETH Climb in August 2025?

#ETH

- Technical breakout: ETH trades above key moving averages with bullish MACD crossover

- Institutional demand: Multiple firms are expanding Ethereum treasury allocations

- Key resistance: $4,500 level represents next psychological benchmark

ETH Price Prediction

Ethereum Technical Analysis: Bullish Momentum Builds Above Key Levels

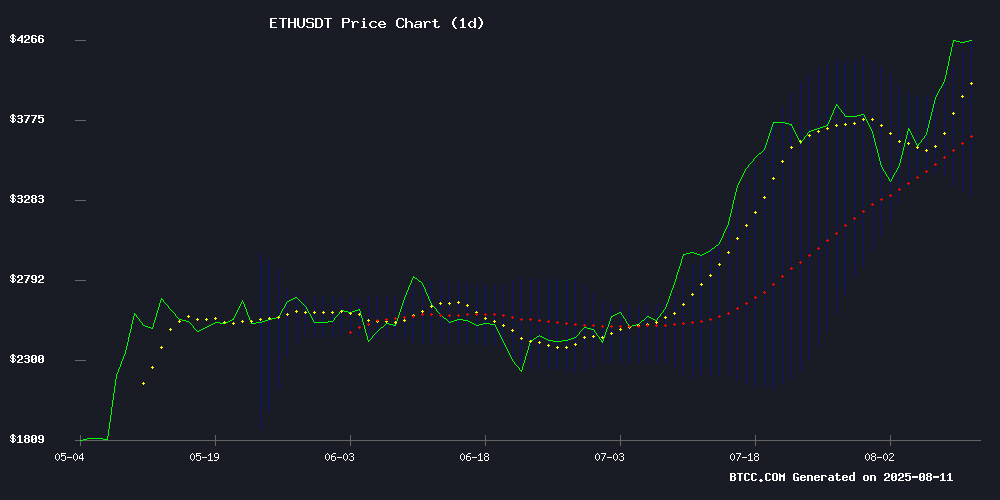

ETH is currently trading at $4,282.75, well above its 20-day moving average of $3,794.18, indicating strong bullish momentum. The MACD shows a bullish crossover with the histogram at 39.88, suggesting upward momentum is accelerating. Prices are testing the upper Bollinger Band at $4,279.11, which could act as resistance. A sustained break above this level may target $4,500 next, according to BTCC analyst Olivia.

Ethereum News Sentiment: Macro Tailwinds Fuel Rally to 2021 Highs

Positive regulatory developments and institutional adoption are driving Ethereum's 43% monthly gain. News highlights include Fundamental Global's expanded ETH holdings, SharpLink Gaming's $2.12B treasury allocation, and Arthur Hayes' bullish reversal. However, Olivia notes risks like the $1M wallet hack and corporate treasury concentration could create volatility NEAR all-time highs.

Factors Influencing ETH's Price

Ethereum Surges to Highest Level Since 2021 Amid Favorable Macro and Regulatory Shifts

Ether breached $4,300 over the weekend, marking its strongest valuation since December 2021 as macroeconomic tailwinds and regulatory clarity converge. The rally reflects broad-based risk appetite fueled by a softening dollar and anticipated Federal Reserve easing, with September now priced for a potential rate cut.

Institutional participation appears to be accelerating following the SEC's recent guidance that liquid staking services won't face securities regulations. This removes a critical uncertainty for ETH-based financial products while coinciding with Treasury adoption and ETF-driven demand. Exchange balances continue declining as coins migrate toward staking protocols.

The second-largest cryptocurrency has gained 43% month-to-date, outperforming Bitcoin as capital rotates toward altcoins. Corporate treasuries and ETF sponsors are accumulating positions amid growing recognition of Ethereum's yield-generating architecture. Regulatory headwinds are easing after US policymakers clarified staking rules and took steps to prevent crypto de-banking.

Ethereum Nears Key Resistance After 43% Monthly Gain—How High Can ETH Climb in August?

Ethereum's price surge past $4,000 marks a pivotal moment for the cryptocurrency, fueled by institutional inflows and Layer 2 advancements. The asset now eyes $4,300, with analysts speculating a run toward $5,000 if momentum holds.

Institutional interest has become a cornerstone of ETH's rally, with Ethereum-focused ETFs attracting $8.7 billion since launch. This capital influx creates sustained buying pressure, reinforcing the bullish technical structure.

Layer 2 solutions like Arbitrum and Optimism are addressing Ethereum's scalability challenges, reducing gas fees and increasing throughput. These improvements are critical for sustaining adoption as network activity grows.

Ethereum Co-Founder Warns of Corporate Treasury Risks Amid $12B ETH Holdings

Vitalik Buterin has sounded the alarm on the growing trend of public companies accumulating Ethereum as part of corporate treasury strategies. Nearly $12 billion worth of ETH now sits on corporate balance sheets, with BitMine Immersion Technologies alone holding $3.2 billion in the cryptocurrency.

While institutional adoption signals mainstream validation, Buterin cautions against leveraged exposure strategies. "Using borrowed capital to amplify ETH positions works until it doesn't," he implies, noting the systemic risks that could emerge during market downturns.

The Ethereum creator acknowledges the accessibility benefits—public companies effectively serve as proxy ETFs for traditional investors. SharpLink Gaming and other listed firms now provide crypto exposure without direct ownership. Yet the very leverage that boosts returns in bull markets may accelerate contagion during corrections.

Ethereum Breaks Past $4K, Back to 2021 Levels but Stronger Than Ever

Ethereum surged to $4,186.70 this week, marking a 20% gain and its highest price in over a year. The rally is supported by strong technical indicators, with the price comfortably above the 9-week exponential moving average of $3,311. Momentum remains bullish, though the Relative Strength Index at 69.58 suggests a potential short-term breather before further upside.

The network has undergone significant transformations since 2021, including major upgrades, ETF inflows, and broader corporate adoption. Ethereum researcher William Mougayar notes that while prices echo December 2021 levels, the underlying infrastructure is fundamentally stronger. Key resistance levels now sit at $4,500-$4,800, with $5,000 in sight.

Fundamental Global Inc. Expands Crypto Holdings with Ethereum Focus

Fundamental Global Inc. (Nasdaq: FGF) has taken a significant step toward deepening its involvement in the cryptocurrency market, particularly Ethereum. The Charlotte-based investment firm filed a shelf registration with the SEC, authorizing the potential offering of up to $5 billion in securities. While the allocation for crypto remains unspecified, the move follows a $200 million private placement in July explicitly targeting ETH acquisition and staking activities.

The Form S-3 filing provides flexibility to issue common stock, preferred shares, debt instruments, or warrants. Notably, it includes an 'at-the-market' provision enabling ThinkEquity to facilitate up to $4 billion in stock sales. This strategic positioning allows the company to capitalize on favorable market conditions while signaling growing institutional confidence in Ethereum's ecosystem.

Russian Hacking Group GreedyBear Steals $1M via Fake Crypto Wallet Extensions

GreedyBear, a Russian cybercrime syndicate, has escalated its crypto theft operations by deploying 150 malicious Firefox extensions. The group impersonated popular wallets including MetaMask, Exodus, Rabby Wallet, and TronLink, netting $1 million in just five weeks.

Security firm Koi revealed the hackers employ 'Extension Hollowing' techniques to bypass marketplace safeguards. Their Firefox-based attack vector proves particularly effective, accounting for the majority of stolen funds. The operation targets English-speaking users globally through a network of phishing sites and nearly 500 infected executables.

Ethereum Breaks $4K as Analysts Flag Remittix as Potential High-Growth Challenger

Ethereum surged past $4,000 this week, peaking at $4,198.35 with a 7.63% daily gain. The rally pushed its market capitalization to $506.79 billion as trading volume spiked 32.7%, reinforcing ETH's dominance in smart contract platforms and DeFi infrastructure.

While Ethereum maintains its stronghold, analysts are identifying Remittix ($0.0895) as a dark horse contender. The payments-focused altcoin, preparing to launch its beta wallet, claims to solve Ethereum's persistent pain points—high gas fees and slow cross-border transactions—through its low-cost settlement layer.

The market's appetite for alternatives grows as Ethereum's scalability limits persist. Projects combining staking rewards with real-world utility like Remittix are attracting capital from investors seeking the next breakout token under $1. Its proposed payment network could capture share in the $860 billion global remittance market if execution matches ambition.

SharpLink Gaming Expands Ethereum Treasury to $2.12B With Latest Purchase

SharpLink Gaming has bolstered its Ethereum reserves with a $85.46 million purchase of 21,959 ETH, bringing its total holdings to 543,898 ETH—valued at approximately $2.12 billion. The acquisition, executed within four hours, underscores the company's aggressive accumulation strategy since shifting its treasury focus to Ethereum in May 2025.

The Minneapolis-based Nasdaq-listed firm recently raised $200 million in capital, earmarked to push its Ethereum holdings past the $2 billion threshold. SharpLink's approach mirrors MicroStrategy's Bitcoin strategy but with a singular focus on Ethereum, positioning it as a rare public company heavily invested in the ecosystem.

Notably, over 95% of SharpLink's ETH is staked, generating passive income while reinforcing Ethereum's network security. Chairman Joseph Lubin, a co-founder of Ethereum, lends further credibility to the firm's bullish stance.

Arthur Hayes Reverses Ethereum Stance as Price Surges Past $4,200

BitMEX co-founder Arthur Hayes has repurchased Ethereum just days after offloading $8.32 million worth of the cryptocurrency. His abrupt reversal follows a 20% price surge that defied his earlier prediction of a downturn. The market movement coincides with bullish long-term forecasts, including VanEck's $22,000 ETH price target for 2030.

Hayes initially sold 2,373 ETH citing macroeconomic concerns, including Federal Reserve policy and geopolitical tensions. The subsequent rally to $4,200 demonstrates the volatility even seasoned traders face when timing crypto markets. His public acknowledgment of the miscalculation underscores the sector's unpredictability.

The episode highlights how institutional figures increasingly move markets through transparent positioning. Hayes' social media disclosures create reflexive effects - his initial sell-off briefly dampened sentiment, while his re-entry amplified the upward momentum.

How High Will ETH Price Go?

Based on technicals and market sentiment, ETH appears poised for further upside with key levels to watch:

| Level | Price | Significance |

|---|---|---|

| Current | $4,282.75 | Testing upper Bollinger Band |

| Next Resistance | $4,500 | Psychological round number |

| 20-day MA Support | $3,794.18 | Dynamic floor for uptrend |

Olivia maintains a short-term target of $4,500 if ETH holds above $4,200, but warns of potential pullbacks to $3,800 if profit-taking emerges.